Selling your house successfully is all about making a killer first impression. The very first things you need to do involve deep cleaning, decluttering, and tackling those little repair jobs you've been putting off. Get this right, and you're setting the stage for everything that follows, from the professional photos to the first viewing.

Preparing Your Home to Impress Buyers

Before your property even hits the market, taking the time to prepare it properly is one of the most powerful things you can do. Buyers often make up their minds within seconds of stepping inside, and you want their immediate reaction to be a resounding "yes".

This isn't about splashing out on expensive renovations. It’s about smart, focused work that makes your home’s best features shine. The aim is to create a welcoming, neutral space—think of it as a "show home." Buyers need to be able to picture their own sofa in the living room, and that’s tough to do when it’s filled with your personal clutter and family photos.

Focus on High-Impact Fixes

First thing's first: walk through your own home as if you were a potential buyer. Be critical. Make a list of all the small but noticeable issues. These are often the little quirks you’ve learned to ignore, but they'll stick out like a sore thumb to a fresh pair of eyes.

Your list might look something like this:

- Fixing that annoying dripping tap in the bathroom.

- Patching up cracks in the plaster or filling old nail holes.

- Replacing any burnt-out light bulbs—every room should feel bright and airy.

- Mending that wobbly cupboard handle or oiling squeaky door hinges.

Sorting these minor problems shows that you've looked after the property. It builds a buyer's confidence right from the start. A home with obvious repair jobs can make people wonder if there are bigger, more expensive problems lurking beneath the surface.

The Power of Decluttering and Deep Cleaning

With the repairs done, it’s time to declutter and depersonalise. I know, this can be the hardest part for many sellers, but it is absolutely crucial. You aren’t just tidying up; you're creating a blank canvas.

A clean, depersonalised, and clutter-free home allows buyers to connect with the property emotionally. When they can visualise their own belongings in each room, they move from being casual viewers to serious contenders.

Pack away family photos, ornaments, and any bulky furniture that makes a room feel cramped. Clear off kitchen worktops and bathroom surfaces. This simple act creates an incredible sense of space and cleanliness that buyers love. For a complete checklist, take a look at our detailed guide on how to prepare a house for sale.

Finally, give your home a proper deep clean from top to bottom. We're talking about shampooing carpets, washing windows until they sparkle, and scrubbing tiles and grout. A gleaming home feels fresh and well-cared-for, leaving a lasting positive impression on everyone who walks through the door.

Getting Your Property Valuation Right

Setting the right price for your home is probably the single most important decision you'll make when selling. It’s a tricky balancing act. Price it too high, and you’ll put off potential buyers, leaving your property to go stale on the market. Go too low, and you could walk away with thousands less than you deserve.

Forget those instant online valuation tools for a moment. To get a real sense of your home's value, you need to dig a little deeper. Experienced sellers and agents don't just pluck a number out of thin air; they conduct a thorough analysis of comparable sales, or 'comps'. This means looking at recently sold properties in your immediate area that are similar to yours in size, condition, and key features. This is your evidence-based starting point.

What the Market Data is Telling You

To price your home effectively, you need to look at the bigger picture. The UK property market is always shifting, with prices reacting to economic news and local demand. For example, recent data shows the average UK house price is currently £268,400, which is a 1.4% increase over the last year.

But that figure doesn't tell the whole story. It varies hugely by property type. Semi-detached homes, for instance, climbed by 2.5% to an average of £275,100, while flats saw a small dip. Understanding these nuances helps you see where your specific property fits into the current climate.

Let's break down the latest average prices to give you a clearer benchmark.

Average UK House Prices by Property Type

| Property Type | Average Price (May 2025) | Annual Increase |

|---|---|---|

| Detached | £415,800 | 2.1% |

| Semi-Detached | £275,100 | 2.5% |

| Terraced | £231,500 | 1.8% |

| Flat/Maisonette | £212,300 | -0.2% |

This data shows a healthy market for houses, while the flat market is a bit softer. This kind of insight is crucial when deciding on your own asking price.

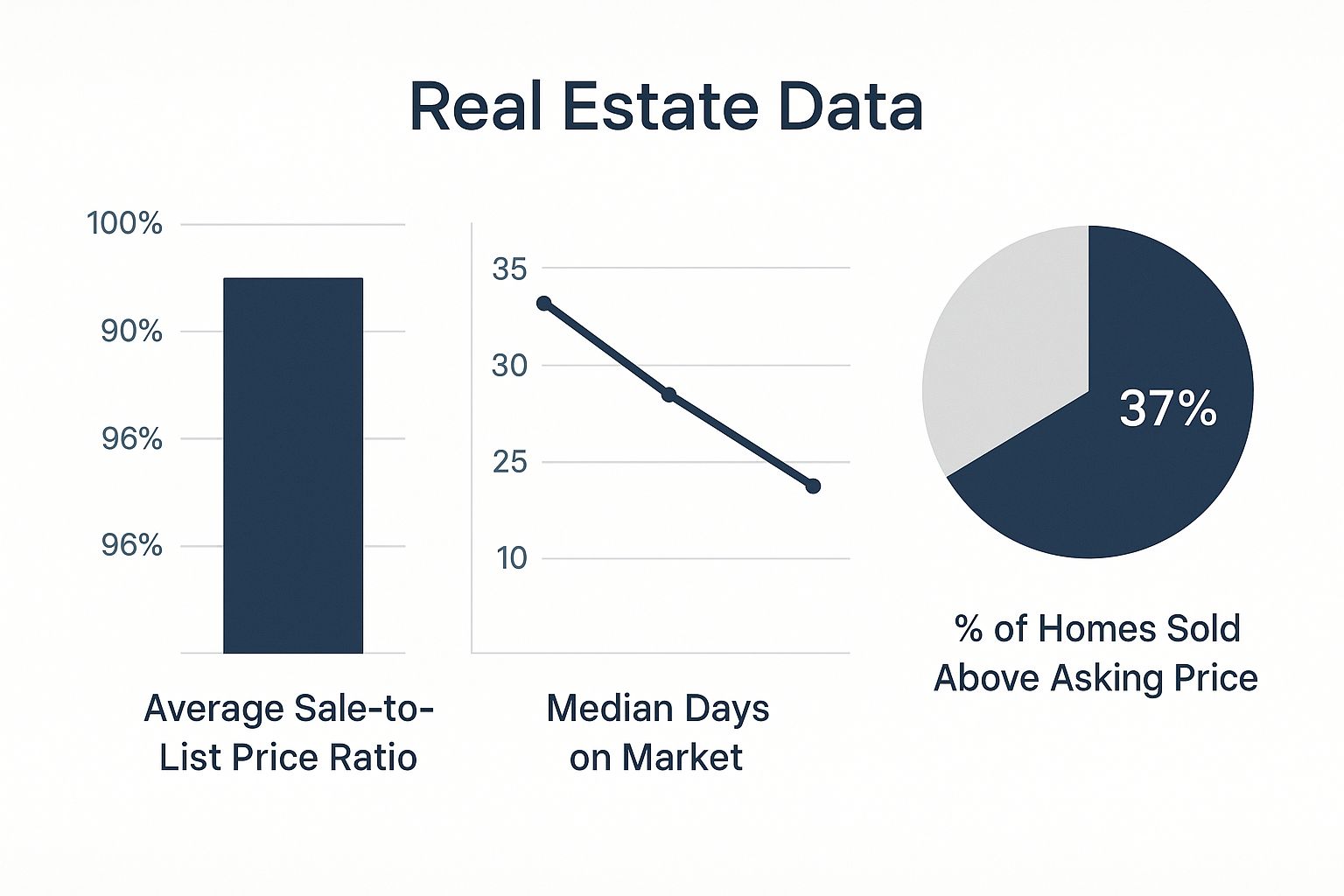

The chart above gives you a snapshot of key market health indicators, like how close sellers are getting to their asking price and how long homes are taking to sell. It’s all valuable context for your pricing strategy.

Get a Professional Opinion (or Three)

Your own research is a great start, but nothing beats professional expertise. We always recommend inviting at least three different estate agents to value your property. Think of it as an interview process—you’re not just getting a number, you're finding a potential partner for one of your biggest financial transactions.

Pay close attention to how each agent explains their valuation.

- Do they show up with a detailed report full of relevant local comps?

- Can they clearly explain their reasoning, pointing to specific recent sales?

- Do they seem realistic, or are they promising you the moon just to get your business?

Be wary of an agent who suggests a much higher price than the others. This tactic, known as 'overvaluing,' is designed to flatter you into signing with them. It often backfires, forcing you into a price reduction a few weeks later once the initial interest has fizzled out—a move that can look desperate to buyers.

A good agent will give you a strategic pricing range and talk you through the pros and cons of launching at different price points. Timing is also part of the equation. Knowing when is the best time to sell a house can affect how aggressively you can price your home from the get-go.

Ultimately, the goal is to combine solid data with multiple professional opinions. This empowers you to set a competitive, realistic asking price that will attract serious buyers from day one.

Choosing Your Agent and Marketing Your Home

With your home prepped and a price in mind, it’s time to find the right person to sell it and get it out there. This is a huge step. Think of your estate agent as more than just a salesperson; they’re your chief marketer, your negotiator, and your guide for what is probably your biggest asset.

Choosing an agent based purely on the lowest commission is a classic mistake. Of course, fees matter, but an agent’s local know-how and their plan to market your specific type of property are far more important. A great agent will have a proven track record of selling homes just like yours in your postcode. They should be able to tell you, clearly and confidently, how they’re going to attract the right buyers.

Finding The Right Agent For Your Sale

I always recommend interviewing at least three agents. It’s the only way to get a feel for different valuations, marketing approaches, and frankly, personalities. You'll also need to decide between a traditional high-street agent and one of the newer online platforms – both have their pros and cons.

Here are a few questions I’d be asking every single one:

- What’s your exact marketing plan? How will they use Rightmove and Zoopla? What else do they do? Social media? Local press?

- How do you manage viewings? Will they be there to show people around, or is that left to you?

- How many similar homes have you sold in this area recently? This question cuts through the fluff. It proves they know the local market.

- What are your commission fees and contract terms? Get a clear breakdown. Watch out for hidden costs or long tie-in periods that you can't get out of.

Ultimately, the right agent is the one who gives you confidence. They should be professional, easy to communicate with, and completely transparent about their process from day one. This partnership is the bedrock of a smooth, successful sale.

Crafting A Standout Property Listing

Once you've picked your agent, the next job is to create a property listing that actually stops people scrolling. In today’s market, professional photography isn't a luxury; it's non-negotiable. Grainy, poorly lit phone snaps can instantly make your home look cheaper in a buyer's eyes.

A great property listing tells a story, it doesn't just list facts. It uses brilliant photos and a compelling description to help buyers picture their own life in your home. It’s about creating an emotional pull before they’ve even set foot inside.

Your listing absolutely must include an accurate, professionally drawn floorplan. Buyers rely on these to understand the home's layout and flow. The description needs to sell the lifestyle, not just the bricks. Instead of "kitchen with window," try something like, "a sun-drenched kitchen perfect for lazy family breakfasts."

A beautifully presented listing, combined with smart advice on staging a house to sell, is what makes the best possible first impression online. This is the work that turns casual browsers into genuinely interested buyers who are keen to book a viewing.

Handling Offers and Navigating Negotiations

That first offer landing in your inbox is a fantastic feeling. It’s the moment all your hard work—the decluttering, the viewings, the endless tidying up—starts to pay off. But don't pop the champagne just yet. This is where the real work begins.

One of the biggest lessons I’ve learned is to look beyond the headline price. A sky-high offer from a buyer stuck in a long, shaky chain can be a recipe for disaster. It’s often far riskier than a slightly lower, cleaner offer from a chain-free buyer who already has their mortgage approved.

Your estate agent should be digging into the details for you. Are they a cash buyer? Do they have a mortgage in principle? Is their own property even on the market yet? These are the questions that separate a solid offer from a hopeful one.

Understanding the Offer Details

An offer is more than just a number; it's a full package of terms. A genuinely strong offer usually has a few key ingredients:

- A rock-solid financial position: The buyer can show you proof of funds, whether that’s a mortgage agreement in principle or a bank statement for a cash purchase.

- A short or non-existent chain: A chain-free buyer is gold dust. It dramatically cuts the chances of the whole thing falling apart weeks down the line.

- Flexibility on timing: A buyer who can align with your moving dates is a massive plus.

- A sensible offer: It needs to be in the same ballpark as your asking price and the property's real market value.

This is also where knowing the wider market really helps. In the first four months of 2025, for instance, the UK saw 395,090 completed property sales. That’s a 29.47% jump from the year before, which tells us the market is active. A busy market can make buyers more confident and competitive.

For a deeper look at these kinds of trends, it's worth checking out the data on UK property transaction history on globalpropertyguide.com.

Navigating Different Negotiation Scenarios

How you play your cards depends entirely on the interest you’ve generated.

If you’ve only had one offer and it’s a bit lower than you’d hoped, don’t just brush it off. It’s a starting point. Your agent can go back, thank them for their interest, and counter with a figure that gets you closer to where you need to be. It opens a conversation.

A bidding war, on the other hand, is a brilliant problem to have, but you need to handle it with care. It's easy to get mesmerised by the biggest number and ignore everything else.

When you have multiple offers on the table, the best approach is to ask all interested parties for their 'best and final' offer by a clear deadline. This keeps things fair and transparent. It forces you to compare each offer properly—price, buyer's situation, and any other conditions attached.

Once you’ve made your decision and accepted an offer, your property's status shifts to 'Sold Subject to Contract' (SSTC). This isn't legally binding yet, but it’s a huge step. Both you and your buyer will now instruct solicitors to kick off the conveyancing process, moving you firmly onto the home stretch.

Managing The Legal Process To Completion Day

Once your sale is agreed, you step into the final, and most legally intensive, phase of selling your home: the conveyancing process. It can feel like you’re wading through a swamp of jargon and paperwork, but knowing the key milestones helps you feel in control as you head towards handing over the keys.

This is where your solicitor really earns their fee. They'll draft the initial contract of sale and send it over to the buyer's solicitor. At the same time, they'll be gathering all the necessary documents from you, which includes things like property information forms and the all-important details about fixtures and fittings.

Navigating Key Conveyancing Stages

The journey from 'Sold Subject to Contract' to 'Completion' isn't always a straight line, but it does follow a structured path. While your solicitor is doing the heavy lifting, staying in the loop means you can anticipate what's coming next and nudge things along if they stall.

This part of the sale is often where delays can creep in. I’ve seen it happen time and again. Common hurdles include:

- Survey Issues: A surveyor might flag an unexpected problem, like damp or a roof issue. This often leads to the buyer trying to renegotiate the price or asking you to fix the problem before they’ll proceed.

- Search Delays: Local authority searches can sometimes take weeks, especially if the council is swamped. There isn't a lot you can do to speed this up, but a good solicitor will be chasing it regularly.

- Mortgage Offer Delays: Sometimes, the buyer’s formal mortgage offer from their lender takes longer to arrive than anyone anticipated.

The single most important thing during this phase is proactive communication. A quick weekly check-in with your solicitor and estate agent keeps everyone on the same page. It helps unblock any small issues before they snowball into major delays.

From Exchange To Completion

Once all the enquiries have been answered and the buyer has their formal mortgage offer in hand, you’re ready for the Exchange of Contracts. This is the real point of no return—the moment the sale becomes legally binding. Your solicitor will exchange signed contracts with the buyer's, and the buyer pays their deposit. A completion date is then officially set in stone.

The gap between exchange and completion is usually about one to two weeks. This gives everyone enough breathing room to sort out the final arrangements. For you, this means booking the removal company and getting everything packed up.

Finally, Completion Day arrives. This is the day the buyer's solicitor transfers the rest of the money to your solicitor. As soon as the funds clear, your solicitor will give the estate agent the green light to release the keys to the new owner. It's done!

Understanding the timeline for these steps is vital. While you might hope for a smooth 6 to 8 weeks, the market can be unpredictable. For instance, UK property transactions saw a sharp drop of 28% year-on-year in April 2025. You can dig deeper into these trends by exploring the latest data on UK property market fluctuations on GOV.UK.

Common Questions About Selling Your House

Getting to the finish line of a house sale often throws up a last-minute whirlwind of questions. From unexpected costs to those tricky ethical grey areas, knowing what might come up can make the whole experience feel a lot less daunting. Let’s walk through some of the most common queries we see from sellers.

One of the biggest worries is figuring out the real cost of moving. It’s never just the estate agent's commission. You’ll also need to budget for legal fees, or conveyancing, which usually land somewhere between £850 and £1,500. And don't forget the other bits and pieces, like an Energy Performance Certificate (EPC) and the removal company itself.

As a rule of thumb, it's smart to set aside about 1-2% of your home's sale price for these associated costs, on top of what you pay your agent. This simple bit of planning stops you from being caught out by surprise bills just when you think you’re done.

What Paperwork Do I Actually Need?

Your solicitor will steer you, but having your documents organised beforehand can seriously speed things up. You'll be asked to fill out property information forms (the TA6 and TA10), which cover everything from boundary disputes to which light fittings you’re leaving behind.

You'll also need to dig out:

- An up-to-date Energy Performance Certificate (EPC).

- Proof of your identity for anti-money laundering checks.

- Any planning permission paperwork for extensions or major changes.

- Guarantees or warranties for work like new windows or damp-proofing.

Getting this little pile of paperwork ready makes the initial legal work far smoother. If you want a more detailed checklist, you can find more answers in our full guide of frequently asked questions about moving house.

How to Handle Tricky Offer Situations

So, what happens if you get a higher offer after you’ve already accepted one? This is known as ‘gazumping’, and while it’s a hot-button issue, it’s a legal reality in England and Wales right up until you exchange contracts. It definitely puts you in an awkward spot.

Legally, you are free to switch to the higher offer. Ethically, it’s a much tougher call. Your estate agent is obligated by law to pass on every offer they receive, but jumping ship can cause your original sale to fall through. If you’re buying another property, this could collapse your entire chain.

Key Takeaway: Gazumping is tempting, but you have to weigh the extra cash against the very real risk of your entire chain falling apart. A secure, slightly lower offer from a buyer who is ready to go is often the safer, smarter choice for a smooth completion.

Deciding what to do isn't a snap judgment. Take a moment to consider the new buyer's position—are they chain-free? Do they have a mortgage in principle? Talk it through with your estate agent. Their job is to help you make a decision that serves your overall goal of moving, not just the immediate financial win.

At Euro Move Direct, we get that selling your home is about more than just finding a buyer. Whether you're moving down the road or across a continent, our professional teams are here to make your transition seamless. Plan your stress-free move by getting in touch with us at https://euromovedirect.com.